Contents of this Post

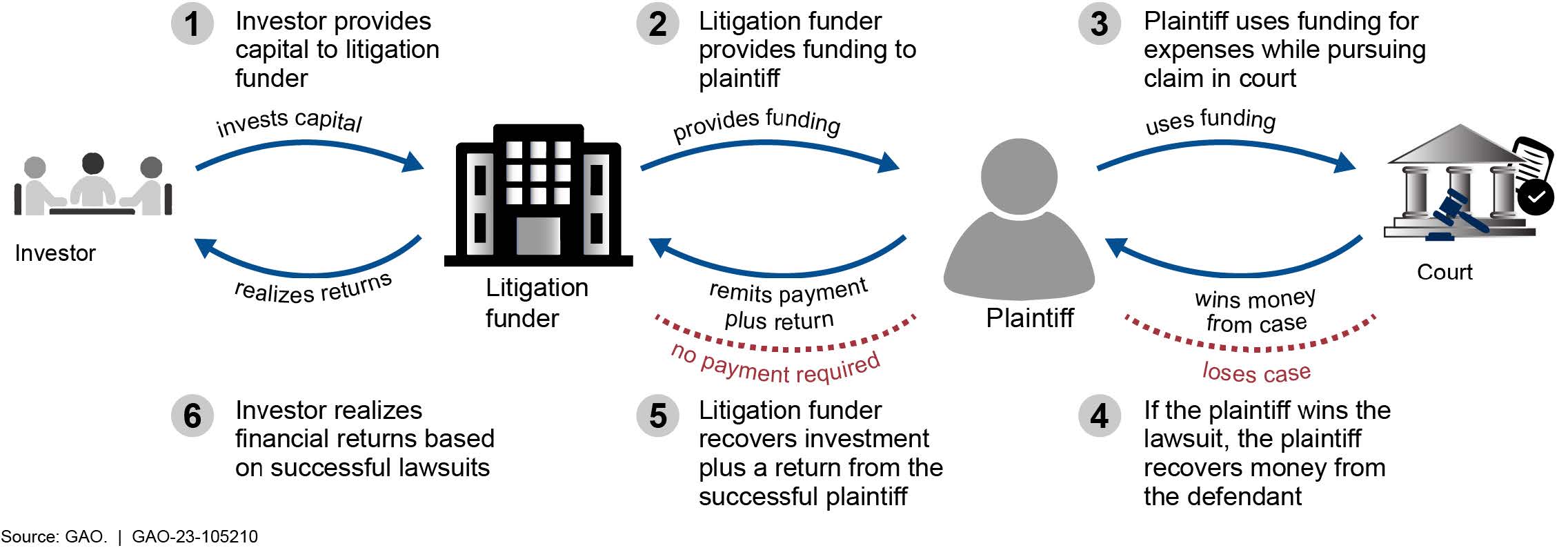

ToggleLegal funding is often referred to as litigation financing or third-party funding. It’s where a third party provides funding to a plaintiff involved in a lawsuit in exchange for a share of the settlement.

Understanding the essence of legal funding Australia becomes essential as the legal domain adapts to evolving financial models.

If you’re in Australia and considering legal funding, there are key aspects you should be aware of.

Understanding Legal Funding

Legal funding is a financial arrangement where a third party, known as a litigation funder. It provides funding to cover the legal costs and expenses associated with a lawsuit. Car accident loans are one of your options, wherein you can obtain funding while pursuing your claim.

In return, the litigation funder receives a portion of the settlement or judgment if the case is successful. This arrangement allows you to pursue legal claims without the financial burden of legal fees.

Here’s how it works:

- Case Assessment: They evaluate the merits of the case, its potential for success, and the expected damages.

- Funding Approval: If the case meets the criteria set by the litigation funder, they approve the funding application. This approval includes determining the amount of funding required.

- Legal Representation: With funding in place, the plaintiff can hire legal representation and proceed with the lawsuit. The litigation funder typically covers legal fees, court costs, and other legal expenses.

- Case Outcome: Legal funding is not a loan but rather an investment in a legal case. In traditional loans, borrowers are required to repay the borrowed amount regardless of the case’s outcome. However, legal funding is contingent on the success of the lawsuit. If the case is unsuccessful, you typically do not owe anything to the funding company.

What to Expect When You Apply

The litigation funding landscape in Australia has experienced significant growth, attributable to factors including:

Regulatory Framework

Litigation funding in Australia operates within a regulatory framework designed to safeguard the interests of plaintiffs. These regulations typically mandate licensing for litigation funders. Also, these adhere to certain codes of conduct.

Diverse Case Coverage

Australia’s legal funding industry caters to an array of cases. However, the availability of funding may vary depending on the nature and potential of the case. Also, not all cases qualify for legal funding.

Funding companies carefully evaluate cases before providing financial assistance. Generally, they look for cases with a strong likelihood of success and a significant potential settlement or judgment.

Personal injury claims, employment disputes, and commercial litigation are some common types of cases that may be eligible.

Costs and Fees

Funding is not free, and companies in funding Australia charge fees for their services. These fees can vary significantly. So, it’s crucial to understand the terms of the funding agreement.

Common fees include:

- Origination fees. These are one-time fees charged when the funding is provided.

- Interest rates. Some funding companies charge interest on the funded amount, while others do not.

- Contingency fees. This is the percentage of the settlement or judgment that the funding company will receive if your case is successful.

If the case is successful, the litigation funder receives a pre-agreed percentage of the settlement or judgment amount. If the case is unsuccessful, the funder typically does not seek repayment. This litigation funding is generally non-recourse.

Factors When Choosing a Litigation Funder

When contemplating legal funding in Australia, choosing the right litigation funder is vital.

Here are some key factors to consider:

Experience in litigation funding

When choosing litigation funders, it’s best to check experience.

An experienced funder will have a deep understanding of the legal landscape and the challenges that litigants face. They also have a great track record of successful legal investments. Look for a funder with a proven history of funding cases similar to yours.

Transparent terms and fees

Litigation funding agreements can be intricate, with various terms and fees. It’s imperative to work with a funder who maintains transparency throughout the process.

Ask for a clear breakdown of all costs. These include interest rates, administrative fees, and any other charges that may apply. Avoid funders who are vague or evasive about their fee structures. This includes hidden costs that can quickly erode the value of your settlement or judgment.

Adequate financial resources

The financial stability of a litigation funder is a critical factor to consider. Make sure the funder has the necessary financial resources to support your case through its entirety.

A well-funded funder can provide you with the security that they won’t pull out of the agreement prematurely. This leaves you in a vulnerable position.

Client reviews

Ask for references from those who have worked with the funder. Research the litigation funder’s reputation. Then, seek feedback or testimonials from previous clients.

Important Tips

Seeking legal financing can be a crucial step in managing the costs associated with legal proceedings. Here are some tips to consider before pursuing legal financing:

- Clearly identify your financial needs and goals related to the legal case. Determine how much funding you require and for what specific purposes (e.g., attorney fees, court costs, living expenses).

- Explore other options for funding your legal case, such as personal savings, loans from family or friends, payment plans with your attorney, or traditional bank loans. Compare the costs and terms of these alternatives with legal financing options.

- Review the terms and conditions of any legal financing agreement before signing.

- Understand the risks associated with legal financing, including the possibility of losing your case and still being responsible for repayment. Assess how the terms of the financing agreement could impact your financial situation in different outcomes.

- Discuss legal financing options with your attorney to get their insights and advice. They may have recommendations for reputable providers or insights into how legal financing could affect your case.

- Be realistic about your ability to repay the legal financing loan. Consider your current income, expenses, and financial obligations. Develop a repayment plan that you can comfortably adhere to.

- Evaluate how legal financing could impact your legal case. Some opponents may use your financing arrangement to discredit your credibility or portray you as financially motivated. Consider how this could affect negotiations or courtroom proceedings.

Consider the long-term implications of legal financing on your financial health and future plans. Develop a strategy for managing any debt incurred and mitigating the impact on your overall financial well-being.

Wrap-Up

For some Australians seeking justice through the judicial system, legal financing can be useful. However, it’s best to weigh the financial risks and benefits cautiously. Choose funding solutions that work with a trustworthy approach.